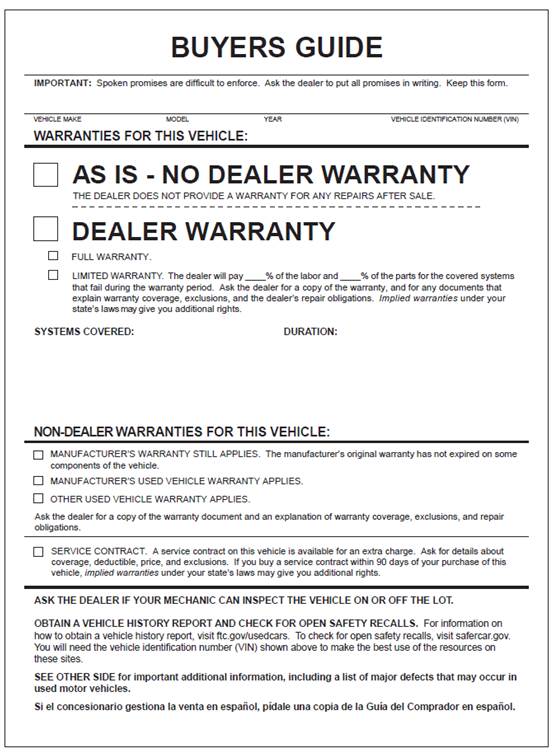

On November 18, 2016 the Federal Trade Commission (FTC) amended the Used Motor Vehicle Trade Regulation (FTC Used Car Rule), which made several changes to the FTC Used Car Buyers Guide. The FTC Used Car Buyers Guide is a sticker approved by the FTC, and required to be affixed on the rear passenger window of used vehicles a dealer is offering for sale. The 2016 amendment to the FTC Used Car Rule purposely corrected a common confusion to the Buyers Guide – the AS IS clause.

Used car dealers often use the AS IS clause of the Buyers Guide to avoid any and all liability arising from used car sales. Whenever a consumer complains about a car purchase, dealers usually refuse to provide any remedy, believing that the AS IS clause shields them from all liability. Many consumers are also convinced that they have no remedy even when the dealer has plainly violated various consumer protection statutes. In an attempt to clear up the confusion, the FTC made the following amendment to the AS IS clause:

Old Rule:

YOU WILL PAY ALL COSTS FOR ANY REPAIRS. The dealer assumes no responsibility for any repairs regardless of any oral statements about the vehicle.

AS IS – NO DEALER WARRANTY

THE DEALER DOES NOT PROVIDE A WARRANTY FOR ANY REPAIRS AFTER SALE.

Contrary to what dealers think, AS IS does not mean that the dealer is completely absolved of any liability after the sale. As the new language suggests, AS IS simply means that the dealer is not offering any warranties with the sale of the vehicle. The Oregon Attorney General has further clarified this distinction in the official commentary of the Unlawful Trade Practice Act:

“Unless explicitly disclosed prior to a sale or lease, a motor vehicle that is offered for sale or lease to the public is represented, either directly or by implication, to be roadworthy when it is sold, to have an unbranded title and to have no undisclosed material defects. . . for used vehicles, even if the dealer states on the FTC Buyers Guide (“As Is”) that the dealer is not providing a warranty, the dealer must still disclose material defects about which the dealer knew or should have known.”

OAR 137-020-0020(3)(o) Official Commentary. In other words, if the dealer is selling a car that is not roadworthy, has a branded title, or has other material defects, the dealer must make a separate disclosure. Simply providing the AS IS disclosure in the FTC Buyers Guide is not enough.

Generally, it is a good idea to write down all of the dealer’s promises or representations on the contract prior to signing. However, even if you signed the AS IS clause and failed to write anything down, you may still have a remedy for purchasing a car with problems if the dealer knew or should have known of the defects.